Why More People Choose Crypto over Traditional Banking?

Demand for Privacy

There has been growing demand for privacy ever since user data and financial transactions became abundant from the increasing adoption of the Internet. For example, Facebook started to take advantage of its users’ information for promotions of targeted advertising, and even selling the data to companies like Cambridge Analytica, which used the data from users to structure political campaigns in 2016.

When it comes to financial transactions, privacy and safety also become paramount. There is a wide understanding that money stored in your bank account do not belong to you, but are held by the bank that you chose. If in some cases the bank collapses, then your holdings will disappear as well. Moreover, you are usually storing money in fiat currencies, which are subjected to inflation, in other words, your money loses its value over time.

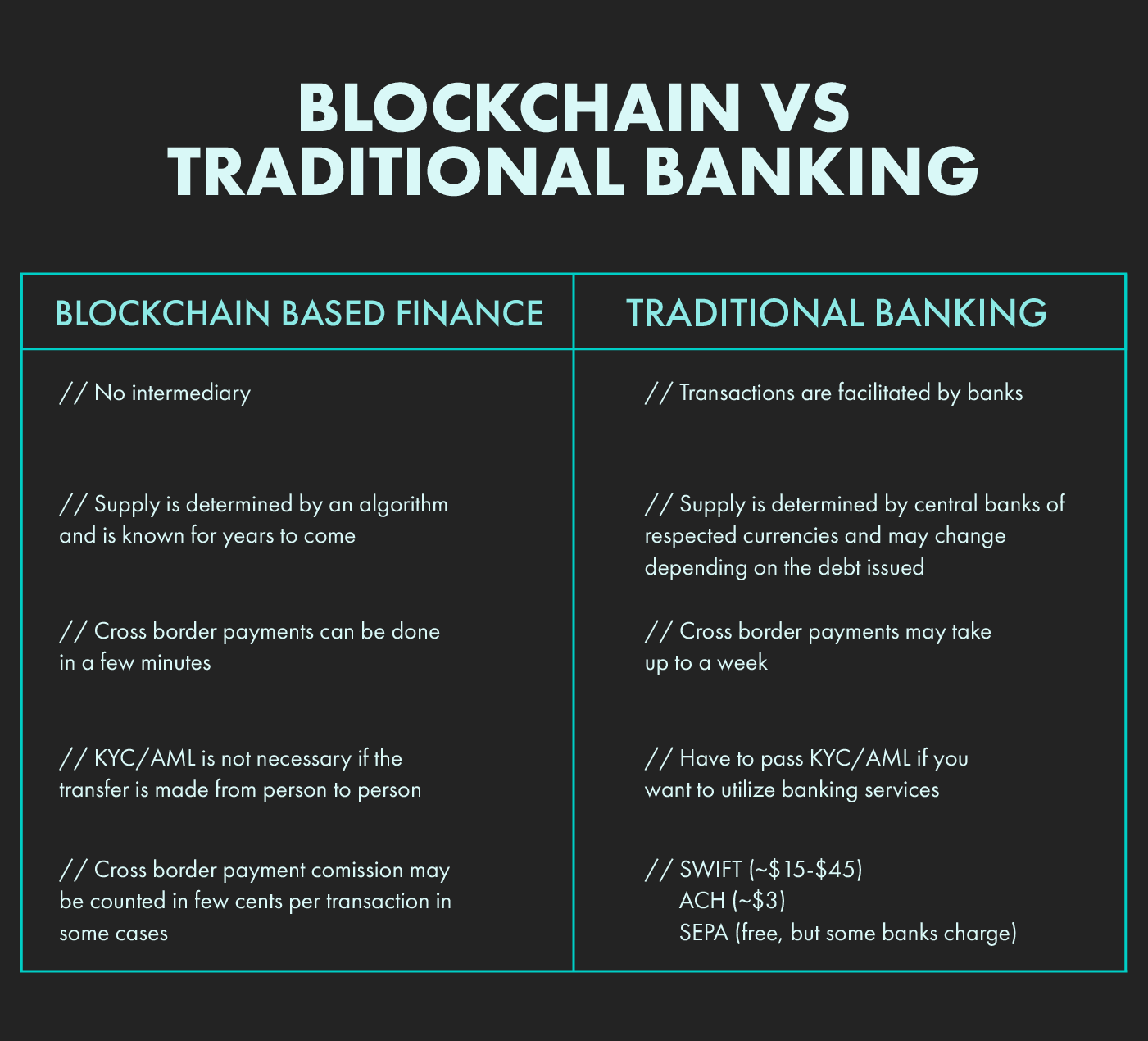

Blockchain technology allows to store data in a decentralized way and depending on characteristics of the chain, it may be transparent, private, fast and secure. Not all chains provide those features and some are not suitable as means of payment, instead better suited as a store of value. Nevertheless, one of the main reasons that some people are interested in blockchain and cryptocurrencies is due to true ownership of one’s assets. There are no intermediaries in on-chain transactions, each transfer is being processed by a benevolent system which makes sure that the ledger was not corrupted. This allows for a stable financial ecosystem with predictable emission rate without intermediaries.

If you have never disclosed your wallet’s address publicly, then most likely this address will be very hard to link to your identity. Some may argue that this kind of privacy is only in demand of criminal organizations and tax evaders, however, for many people, it's just a desire to keep private information (including about one’s financials) to oneself. After all, the US dollar is being used by criminal organizations too, and there are lots of ways to legally manage taxes in an efficient way.

What can be considered privacy on blockchain?

As mentioned above, privacy on blockchain can be relative. As some of you may know, Bitcoin is not necessarily private but instead more transparent. The flow of coins is public, each wallet address displays the amount of funds on it and shows where they came from. Nevertheless, due to the fungible nature of bitcoin, it would still be possible to protect your privacy. If someone created a brand new BTC wallet and used Bitcoin Mixers or Tumblers, they could protect the information about the origin and amount of their funds.

There are currencies that do not display data of balance and transaction flow, such as Monero, Zcash, DASH to name a few of the known ones. Those cryptocurrencies are built for extreme data protection with very limited information released on their chains.

Blockchain vs Traditional Banking

Decentralized Finance

Decentralized Finance (DeFi) is another area where blockchain technology could satisfy the demand for privacy in the coming future. As you may know, the US market is highly regulated and is not easy to access to most cryptocurrency exchanges due to strict requirements from the SEC. Moreover, a cryptocurrency project may face some problems if an American citizen invests in a project abroad.

Decentralized applications largely do not require KYC, they are not incorporated, and in some cases, even the team behind isn’t known, thus, SEC has no way to persecute the company. Unlike many popular exchanges that are not allowed to operate within the United States, Decentralized Exchanges like UniSwap, Pancake Swap, Sushi Swap can operate without any problems. They do not require KYC and only require a WEB 3.0 cryptocurrency wallet such as MetaMask to trade. People who highly value their security would see value in DEXs.

Moreover, DeFi allows access to a full spectrum of financial services such as banking, loans, mortgages, asset trading and even contractual relationships without passing by multiple middlemen. Cutting out those middlemen creates a much more efficient ecosystem which rewards participants without losing a fraction of profits. For example, if you deposited money in a bank for 1% annually, the bank would loan it to someone at a higher percentage and keep the difference. In decentralized finance, this commission will not be kept by anyone other than real peer-to-peer participants.

Central Bank Digital Currencies

Central Bank Digital Currency or CBDC can potentially be a solution to some of the issues that are present in the current financial system, however it is important to be aware of the privacy aspect of CBDCs. Blockchain technology can be used in many different ways, it can provide extreme transparency and tracking or it can be used to create private and untraceable transactions. Naturally, Central Banks would not be in favor of full privacy solutions as that would not allow them to monitor illicit activity such as money laundering. AML regulations are needed to prevent criminal financial activity, however privacy is still in demand.

CBDCs could be a mix which would utilize some of the best things that DeFi could offer while at the same time provide an unchangeable ledger of transactions with predictable supply. Nevertheless, it remains a question if this system could be fully decentralized as money supply will remain in the hands of Central Bank regulators.

Conclusion

It is undeniable that Blockchain and cryptocurrencies create a new type of ecosystem which is private, secure and transparent at the same time. We all value our privacy to varying extent, and disclosing one’s financials can be considered very private information. Because of the decentralized nature of blockchain technology one can ensure that their privacy stays secured and protected. Nevertheless, it is not clear how such privacy can be integrated into the current KYC and AML requirements, and thus, we will most likely not see CBDCs embracing privacy fully.

Cryptocurrencies have already attracted a lot of attention from the public and that will continue to be so in the coming years. By now, most people have heard in some way or another about cryptocurrencies, and it is only a matter of time before even more people start to understand the core value of them, which is real control of funds and protection of your personal data. We can expect that centralized and regulated payment solutions will continue to be a part of our everyday lives, perhaps with Blockchain layer on top, however there will also be more people who are holding cryptocurrencies either to hedge their finances or just to support the idea of decentralization and privacy.

Subscribe to FAS today or leave us a message if you would like to scale up your business in the Blockchain domain.